Are you a crop or livestock farmer in Minnesota? Do you have a home, shop, or barn that rely at least partially on electricity? If so, you can benefit from your own solar installation to provide your own power AND offset your operational costs. Here’s how…

- Powering your home, shop, or barn with solar can reduce or eliminate your electric utility bill.

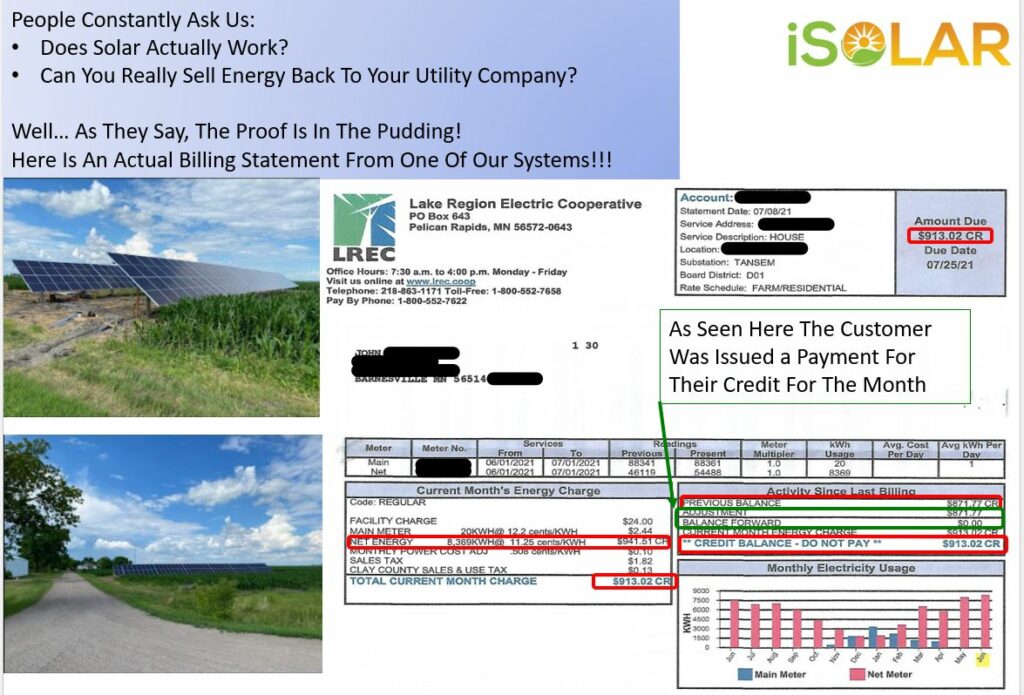

- Excess production can be sold back to your utility (income) or stored for future use or sold back to your utility.

- Reduction in taxable income through tax credits (26%) (1) & depreciation worth another 25% of project cost depending on your taxable income.

- Depending on your site’s production, your return on investment is anticipated in 5-10 years. Excess production beyond that time is pure income.

- Investment is protected by Lloyds of London for 30 years of guaranteed energy production.

Farmers are among the hardest working, most innovative, and most efficient producers in the state. We at iSolar are a Minnesota based company with experience in rural solar project development, installation and maintenance. We would like to partner with you to improve your energy profile and bottom line.